ccspoilgame.online

Categories

Why Do Banks Refinance

There are a variety of reasons people choose to refinance, including reducing their monthly payment, shortening their loan term or tapping their home equity to. Should I refinance my mortgage? · To reduce your monthly payment. · To get a lower interest rate. · To pay off your home loan faster. · To receive some needed cash. You can acquire an influx of cash for a pressing financial need. You can set a shorter loan term, allowing you to save money on the total interest paid. Ask your mortgage lender about your options. Should I refinance my home loan to buy a car? If you can refinance your home loan at a lower interest rate that. 1. What is your goal for refinancing? Most people refinance to save money: You want to get a lower interest rate, lower your monthly payment. When you refinance your education loans, you're using funds from one private lender to pay off higher-interest loans you have with other lenders. In short, they take advantage of lender credits to cover your closing costs. And these lender credits are generated by offering you a higher interest rate than. A mortgage refinance loan essentially replaces and reduces your current home loan rate, allowing you to streamline your finances. Apply Online Today! Should You. One of the best and most common reasons to refinance is to lower your loan's interest rate. Historically, the rule of thumb has been that refinancing is a good. There are a variety of reasons people choose to refinance, including reducing their monthly payment, shortening their loan term or tapping their home equity to. Should I refinance my mortgage? · To reduce your monthly payment. · To get a lower interest rate. · To pay off your home loan faster. · To receive some needed cash. You can acquire an influx of cash for a pressing financial need. You can set a shorter loan term, allowing you to save money on the total interest paid. Ask your mortgage lender about your options. Should I refinance my home loan to buy a car? If you can refinance your home loan at a lower interest rate that. 1. What is your goal for refinancing? Most people refinance to save money: You want to get a lower interest rate, lower your monthly payment. When you refinance your education loans, you're using funds from one private lender to pay off higher-interest loans you have with other lenders. In short, they take advantage of lender credits to cover your closing costs. And these lender credits are generated by offering you a higher interest rate than. A mortgage refinance loan essentially replaces and reduces your current home loan rate, allowing you to streamline your finances. Apply Online Today! Should You. One of the best and most common reasons to refinance is to lower your loan's interest rate. Historically, the rule of thumb has been that refinancing is a good.

This guide explains when it's ideal to refinance your mortgage. It also discusses circumstances when holding off may be a more sound idea. Only 15% of homeowners in your shoes would consider sticking with their original lender when they refinance, according to J.D. Power data. How Much Do You. Why refinance? · Take advantage of today's low rates · Reduce your monthly payments with terms tailored to your needs · Convert existing equity into cash for home. When you refinance, you're taking out a new loan to pay off and replace your current mortgage, which means you'll need to qualify all over again. Each lender. Generally, the reason to refinance a loan, such as a car loan, is to get a lower interest rate, and therefore a lower monthly payment. Through this type of refinancing, you take out a new loan for more than your current mortgage balance and pocket the difference as cash. You can use the funds. Refinancing your mortgage can save you thousands of dollars by lowering your interest rates and your monthly payments. You may also be able to shorten your. In a rate and term refinance, you would typically be getting a new mortgage with a smaller interest rate, as well as possibly a shorter payment term (30 year. How does a refinance work? Typically, a refinance requires a property appraisal, processing, and closes in about a month. The terms of the new mortgage may. Best Mortgage Refinance Lenders of September · Best Mortgage Lenders for Refinancing · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of. But the most common purpose is to obtain a lower interest rate and lower monthly payments. In the latter case, the decision to refinance should be based on. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. If you get a mortgage or refinance from a mortgage broker and want a HELOC, you most likely will need to go to another lender. For brokers, HELOC's aren't very. PNC offers a variety of refinance loans that address a variety of needs. When you apply, a Mortgage Loan Officer will help you determine the loan that's best. Most experts recommend refinancing a mortgage if you can lower your current interest rate by at least to 1 percent. Also, it's a good idea not to plan to. At some point, you might consider refinancing your home. Doing so may lower your monthly mortgage payments and/or save on interest over the life of your. When should you opt for home loan refinance? · 1. When you get a lower rate of interest: · 2. When you want to switch from fixed rate to floating or adjustable. Refinancing for a lower interest rate could not only save you money - it could also help you pay off your home loan sooner. It means your repayments might be. You can refinance to pay your home loan off faster or convert a portion of your equity into cash to make a large purchase, cover the cost of home repairs or. A cash-out refinance is an alternate to a home equity loan. Cash-out refinancing to a conventional, FHA or VA loan may get you a better rate and lower.

Cash Out Cost

On the flip side, "Cash Out" is money leaving the business. It goes towards operating expenses such as payroll, rent and utilities. Other major categories. Turn every day into a payday. Get access to your money as soon as you earn it with EarnIn's Cash Out. Know more about the app here There is always a no-cost. Standard transfers are free and arrive within business days. Instant transfers are subject to a % % fee (with a minimum fee of $) and arrive. Standard. With eligible linked bank account. No Fee (when no currency conversion is involved) ; % of amount transferred. For first-time users of the VA loan benefit, the VA Funding Fee on a Cash-Out refinance is %. For those reusing their benefit, the VA Funding Fee on a Cash-. Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · Closing costs. Closing costs for a cash out refinance can average between 2% and 6% of the loan amount according to Forbes. Sometimes you can add these costs. Define Cash-out Fee. means the fee payable to a dealer for each cash out transaction. Are there fees for a cash-out refinance? · Origination fees · Underwriting fees · Appraisal fee (if applicable) · Title fees. On the flip side, "Cash Out" is money leaving the business. It goes towards operating expenses such as payroll, rent and utilities. Other major categories. Turn every day into a payday. Get access to your money as soon as you earn it with EarnIn's Cash Out. Know more about the app here There is always a no-cost. Standard transfers are free and arrive within business days. Instant transfers are subject to a % % fee (with a minimum fee of $) and arrive. Standard. With eligible linked bank account. No Fee (when no currency conversion is involved) ; % of amount transferred. For first-time users of the VA loan benefit, the VA Funding Fee on a Cash-Out refinance is %. For those reusing their benefit, the VA Funding Fee on a Cash-. Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · Closing costs. Closing costs for a cash out refinance can average between 2% and 6% of the loan amount according to Forbes. Sometimes you can add these costs. Define Cash-out Fee. means the fee payable to a dealer for each cash out transaction. Are there fees for a cash-out refinance? · Origination fees · Underwriting fees · Appraisal fee (if applicable) · Title fees.

Turn every day into a payday. Get access to your money as soon as you earn it with EarnIn's Cash Out. Know more about the app here There is always a no-cost. That's not unique to this type of refi option, though. Any time you refinance your mortgage, you'll need to pay closing costs — again, because you're taking out. That's not unique to this type of refi option, though. Any time you refinance your mortgage, you'll need to pay closing costs — again, because you're taking out. Learn about cash-out refinance mortgages and find out if accessing your home equity is right for you. Check mortgage refinancing rates at Wells Fargo. Cash-out refinance closing costs: How much you'll pay. Refinance closing costs typically range from 2% to 6% of your loan amount, depending on your loan size. If you withdraw money within the first six days after deposit, the penalty is at least seven days' simple interest. Review your account agreement for policies. You can refinance your existing loan by using a rate-and-term refinance to get a lower interest rate, change the loan term or length, or change the loan type. Now Nagad customers can enjoy the lowest ever Cash Out rate taka per 1, taka using the Nagad Regular App, 15 taka per 1, taka using Nagad Islamic. You can use your Wise card like any other bank card to withdraw money at ATMs around the world. The exact fees you pay depend on where your card was issued. The loan proceeds are first used to pay off your existing mortgage(s), including closing costs and any prepaid items (for example real estate taxes or. Your actual cash-out amount may be less. It will be calculated by taking 80% of your property's actual value (as determined by a full appraisal) and subtracting. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. The 20% Tax Withholding for a (k) Early Withdrawal. You can expect 20% of an early (k) withdrawal to be withheld for taxes. In the case of a year-old. Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · See current cash-out refinance mortgage rates using NerdWallet's cash-out refi rate tool. A cash-out refinance replaces your current mortgage with a loan. The cash advance fee is an amount you're charged upfront to withdraw cash using your credit card. The credit card company charges this fee as soon as you take. bKash is the fastest and safest medium of financial transaction, bKash makes your life simple with Send Money, Add Money, Pay Bill, Mobile Recharge. Marginal Tax Rate. The highest percentage of tax applied to the last dollar of income, based on the income tax rates set annually by the federal government that. 2. Out-of-network ATM fee ATM fees from both your bank and the ATM operator can add up when you withdraw cash often. The big brick-and-mortar banks charge.

How Much Does It Cost To Solar Power Your Home

With a solar PPA, consumers agree to purchase the power generated by the system at a set price per kilowatt-hour of electricity produced. With both of these. On average, you'll save between % annually on your electric bills with community solar. Learn more about how community solar costs fluctuate. What does your. The average cost for a 6-kilowatt (kW) solar panel system is $17, That price drops to $12, after the full federal solar investment tax credit (ITC). The average cost of residential solar systems in the US is $ cents per watt, according to the Solar Energy Industries Association's (SEIA) latest figures. It costs about $30, to install solar panels. That's a big number, but incentives usually lower it significantly. In the U.S, average residential solar systems 6 kilowatts in size have a starting price of about $17, before incentives. You can calculate the cost for your. Their cost is between 90 cents and $1 per watt. Thin-film solar panels, which have an efficiency rate ranging from 10% to 13%, are the least efficient solar. On average, our customers pay $ per month when financing an kilowatt residential solar system. Other customers pay as little as $99 per month. Every home. The average cost of installing solar panels in California falls between $10, and $13, after incorporating the 30% solar federal tax credit. With a solar PPA, consumers agree to purchase the power generated by the system at a set price per kilowatt-hour of electricity produced. With both of these. On average, you'll save between % annually on your electric bills with community solar. Learn more about how community solar costs fluctuate. What does your. The average cost for a 6-kilowatt (kW) solar panel system is $17, That price drops to $12, after the full federal solar investment tax credit (ITC). The average cost of residential solar systems in the US is $ cents per watt, according to the Solar Energy Industries Association's (SEIA) latest figures. It costs about $30, to install solar panels. That's a big number, but incentives usually lower it significantly. In the U.S, average residential solar systems 6 kilowatts in size have a starting price of about $17, before incentives. You can calculate the cost for your. Their cost is between 90 cents and $1 per watt. Thin-film solar panels, which have an efficiency rate ranging from 10% to 13%, are the least efficient solar. On average, our customers pay $ per month when financing an kilowatt residential solar system. Other customers pay as little as $99 per month. Every home. The average cost of installing solar panels in California falls between $10, and $13, after incorporating the 30% solar federal tax credit.

Cost of Solar Panels Per Square Foot ; COST TO INSTALL SOLAR PANELS ON HOUSE ; Home Size (SF). Average Cost ; 1, $4, – $5, ; 1, $7, – $8, ; 2, Solar Panel Installation Stat. According to a January article published by Forbes, the average cost of solar panels is $16,, which can double based on. Solar panels cost anywhere from $3, to $55,, including professional labor and materials. Most homeowners pay an average of $27, on their solar. area per home. Step 3 10 watt/ft2 is the average energy usage per ft2. Step 4 $9/watt is the average retail cost of a typical solar system installed. Step 5. Solar panel costs typically range from $17, to $23,, but many homeowners will pay around $20, on average. Solar panels are a considerable. The cost of solar panels can really vary. For a 4, sqft home in Texas, including batteries, you might expect to pay between $55k and $k. As a rule of thumb, a couple who are home most of the time and want an entry level system can expect to budget for under $10, From here, the price climbs. National averages for solar pricing at $ per square foot before accounting for the federal tax credit. After claiming the 30% credit, net costs drop to. Learn about the factors influencing the cost of solar panels for a sq ft house. From electricity usage to roof space, estimate solar panel costs for. The average installation on an American home is a 5 kilowatt (5kW) system. For , the average cost per watt of solar systems in the US is $ cents. So. Solar panels for a home will cost between $25, and $50, before incentives are utilized. After utilizing the 30% federal tax credit, homeowners can expect. Using this measurement, 5, Watt solar system (5 kW) would have a gross cost between $15,00 and $25, The price per watt for larger and relatively. In New York, the average cost of a solar panel system ranges from around $30, to $50, before tax credits. The cost-per-watt in New York averages around. The upfront price for an average-sized residential solar system has fallen from $40, in to about $25, today. Meanwhile, utility-scale solar now costs. Solar Panel Installation Stat. According to a January article published by Forbes, the average cost of solar panels is $16,, which can double based on. Solar panels cost anywhere from $3, to $55,, including professional labor and materials. Most homeowners pay an average of $27, on their solar. Looking at national average pricing data, we found that the cost of owning a 5 kW solar system ranges from $ to $, or from $ to $ per watt. Prices in the SMUD service area generally range between $ and $ per watt before tax credits and rebates. What is the likely payback on my investment, in. As of August , the average solar panel system costs $/W including installation in California. For a 5 kW installation, this comes out to about $11, To answer this question, let's take a look at the basic price range for solar panel installations. The average cost for solar equipment in the U.S., based on.

Best Crm Software For Business

Top CRM platforms to build your business ; Base License. Starter Customer Platform. Starter Suite. Bigin Premier. Standard ; Pricing. $. $. $. $. We have a long list of the best CRM software for a small business that you can use to find the right option for your business. The Best CRM Software of · HubSpot CRM:Best for Integrations · Creatio:Best for Automation · Zoho CRM:Best for Remote Teams · HoneyBook:Best All-in-One. What are the best CRM software tools? 1. Keap; 2. ccspoilgame.online; 3. Salesforce; 4. Creatio; 5. Salesflare; 6. HubSpot; 7. Zoho. Our top three selections remain Apptivo CRM, Salesforce Sales Cloud Lightning Professional, and Zoho CRM, services that earned our Editors' Choice distinction. products ; Pipedrive · (2, reviews) ; monday CRM · ( reviews) ; GreenRope · ( reviews) ; Capsule · ( reviews) ; Zoho CRM · (6, reviews). Keap is a powerful contact management-driven CRM designed to help companies manage customers at each point of the sales cycle. It does this thanks to its highly. ActiveCampaign is a CRM software that is ideal for small and medium-sized businesses looking to grow through improved customer relationships. With integrated. CRM software for small business replaces the multitude of spreadsheets, databases and apps that many businesses patch together to track client data. On top of. Top CRM platforms to build your business ; Base License. Starter Customer Platform. Starter Suite. Bigin Premier. Standard ; Pricing. $. $. $. $. We have a long list of the best CRM software for a small business that you can use to find the right option for your business. The Best CRM Software of · HubSpot CRM:Best for Integrations · Creatio:Best for Automation · Zoho CRM:Best for Remote Teams · HoneyBook:Best All-in-One. What are the best CRM software tools? 1. Keap; 2. ccspoilgame.online; 3. Salesforce; 4. Creatio; 5. Salesflare; 6. HubSpot; 7. Zoho. Our top three selections remain Apptivo CRM, Salesforce Sales Cloud Lightning Professional, and Zoho CRM, services that earned our Editors' Choice distinction. products ; Pipedrive · (2, reviews) ; monday CRM · ( reviews) ; GreenRope · ( reviews) ; Capsule · ( reviews) ; Zoho CRM · (6, reviews). Keap is a powerful contact management-driven CRM designed to help companies manage customers at each point of the sales cycle. It does this thanks to its highly. ActiveCampaign is a CRM software that is ideal for small and medium-sized businesses looking to grow through improved customer relationships. With integrated. CRM software for small business replaces the multitude of spreadsheets, databases and apps that many businesses patch together to track client data. On top of.

Look for a CRM that seamlessly integrates with your existing systems, such as ERP, supply chain, and more. The best CRMs allow your business data to flow. Top 10 best CRM software tools · Freshsales · Salesforce · MS Dynamics · Zoho CRM · Insightly · HubSpot · Copper · Outreach. Outreach is a sales engagement. We've analyzed the most popular CRMs in the market so you can select the one that best fits your business. Salesforce: Best CRM for Large Agencies Salesforce is one of the most popular and reliable CRM software. Thanks to its numerous capabilities, it seamlessly. Need top of the line CRM software? Our best picks combine usability, automation and integrations to boost sales and marketing. Pipedrive is a CRM tool that automates repetitive processes. Its intuitive interface lets teams manage leads and close more deals. Insightly CRM. Get everything in one place. Use a CRM to streamline sales processes, improve profitability, and create long-term customer relationships. Capsule CRM stands out in the crowded field of customer relationship management software with its unique blend of simplicity and power. Do more with Capsule CRM. Mailchimp is a marketing automation platform that offers various CRM solutions for small businesses, such as audience management, workflow automation, contact. Claritysoft provides simple CRM software that helps your business grow more efficiently. With Claritysoft CRM, you can bring together your customer information. Zoho CRM comes with a streamlined, easy-to-use interface that can help you start selling in no time. Top CRM platforms to build your business ; Base License. Starter Customer Platform. Starter Suite. Bigin Premier. Standard ; Pricing. $. $. $. $. Popular CRM Solutions Salesforce Sales Cloud. Salesforce's Sales Cloud is the world's number one sales application. This solution stores and manages the vital. Zendesk is a great CRM software option for small businesses that want to deliver better customer support and service. With Zendesk, you can track each and every. A solution like 1CRM that can be customized to the unique needs of your own business will likely be the best option. You can enable additional features as you. In this post, Mopinion will zoom in on 15 of the best (and top-rated) CRM software for small businesses. Best CRM Software in Top 10 Platforms · 1. Salesforce: The Brain of Your Organization · 2. HubSpot CRM: A Popular Choice That Just Works · 3. Adobe: Marketo. Whether you're a small business owner or a sales, marketing, IT, or customer support team, Salesforce has the perfect CRM solution. Known for its versatility. Top 10 CRM tools · 1. HubSpot CRM · 2. Salesforce Lightning · 3. Zoho CRM · 4. Insightly · 5. Streak · 6. Salesflare · 7. Creatio CRM · 8. Freshsales CRM. A modern, integrated, cohesive customer relationship management (CRM) system is the best way to support teamwork and collaboration in this new virtual sales.

Is Ninja A Good Blender

Ninja® Nutri-Blender Pro with Auto-iQ® | BN out of 5 stars, average rating value. Read Reviews. Same page link. * OZ. FULL-SIZE PITCHER: Great for making large batches of smoothies and frozen drinks for the whole family. * TOTAL CRUSHING® & CHOPPING BLADE ASSEMBLY: The. Ninja blenders are known for their powerful motors and versatile blending capabilities. They often have high-speed settings and multiple blending modes. I love my Ninja Blender It's simply the best! I use it often when I make salad dressings or smoothies and they turn out perfect every time! Great to have in the Kitchen! This little blender literally DOES IT ALL! You can chop stuff up, make shakes and slushies, puree food, mix, ccspoilgame.onlinehing! The Nutri Ninja is a versatile, feature-rich smoothie-maker that we found could blend powerfully and consistently. Its FreshVac oxygen pump accessory helps make. Powerful blender with the perfect settings to make drinks, smoothies, and acai bowls. Not too large, fits easily on counter tops. Very easy to clean as it. A watt motor means that the Ninja Fit Personal Blender can handle anything you throw at it — from ice to whole almonds to frozen berries — without stalling. A powerful blender that can handle frozen fruits and vegetables at a reasonable price. I am very pleased!! I have used this several times a week. Ninja® Nutri-Blender Pro with Auto-iQ® | BN out of 5 stars, average rating value. Read Reviews. Same page link. * OZ. FULL-SIZE PITCHER: Great for making large batches of smoothies and frozen drinks for the whole family. * TOTAL CRUSHING® & CHOPPING BLADE ASSEMBLY: The. Ninja blenders are known for their powerful motors and versatile blending capabilities. They often have high-speed settings and multiple blending modes. I love my Ninja Blender It's simply the best! I use it often when I make salad dressings or smoothies and they turn out perfect every time! Great to have in the Kitchen! This little blender literally DOES IT ALL! You can chop stuff up, make shakes and slushies, puree food, mix, ccspoilgame.onlinehing! The Nutri Ninja is a versatile, feature-rich smoothie-maker that we found could blend powerfully and consistently. Its FreshVac oxygen pump accessory helps make. Powerful blender with the perfect settings to make drinks, smoothies, and acai bowls. Not too large, fits easily on counter tops. Very easy to clean as it. A watt motor means that the Ninja Fit Personal Blender can handle anything you throw at it — from ice to whole almonds to frozen berries — without stalling. A powerful blender that can handle frozen fruits and vegetables at a reasonable price. I am very pleased!! I have used this several times a week.

The Ninja Nutri Blender Pro is an amazing blender. We tried different kinds of smoothies and it turned out great. It blends well, faster and a lot more than. It is a little loud, but most blenders are. With all that power I wouldn't expect it to be silent. It blended our smoothies very quick and efficiently. There. This Ninja blender is amazing because we have made several different smoothies and milkshakes and they come out perfectly blended every time. The blender has a. Other shoppers love the Ninja Foodi Power Blender because “it's not too big and bulky” so it can sit on the benchtop permanently, and “can do things my previous. Blenders & Kitchen Systems, The Ninja Blast™ Portable Blender brings high-speed Ninja blending power on the go with a cordless, hand-held design. For example, find the Ninja BLAMZ Mega Kitchen System for 30% off and under $ It features a ounce pitcher, 8-cup food processor and a ounce single-. Overall, it's a nice purchase. Bottom Line Yes, I would recommend to a friend. Was this review helpful to you. Compact, easy to use and transport, and suitable for blending a variety of ingredients (but less effective at blending ice and fibrous greens such as kale). [This review was collected as part of a promotion.] The Ninja nutri- blender plus is a high quality powerful blender. The instructions are very clear making for. is Ninja's most versatile and powerful kitchen system–slice, shred, and grate I wanted to return the product, but I find out that it is good for me. What We Like About It: The Ninja Chef blender design which includes a powerful watt motor, a sharp 4-prong blade, and a tamper to process tough ingredients. Ninja® Professional Plus Blender DUO® with Auto-iQ® · TOTAL CRUSHING® BLADES: Crush ice for smoothies and frozen drinks with peak-watts of power. · OZ. Icy Drinks (Smoothies): This model performed very good in our icy drinks (Smoothies) test, which gauges how well the blender mixes up Pina Coladas. Ninja: Blenders. Love to start your day with a breakfast smoothie? Or pack a healthy soup bowl for work? A blender is just the appliance for you. Whip up. Ninja recently came out with the Ninja Ultima Blender Plus for $ It has a watt, horsepower motor. All these watts and horsepower talk makes my. Overall, THE NINJA is amazing and excellent. Our smoothie was quickly made and perfectly blended. I am beyond impressed and can't wait to use this blender for. The Ninja Professional Plus Blender with Auto-iQ features a new modern design and a more powerful motor than Ninja's original Professional Blender (Disclaimer). The Ninja Nutri-Blender Plus is the perfect tool for making healthy recipes in the kitchen. Pro Extractor Blades Assembly fully breaks down ingredients. Ninja® Fit Personal Single-Serve Blender, Two oz. Cups, QBSS. out of 5 Stars. reviews. Save with. Walmart Plus. Free shipping, arrives in 2. This is the best blender I've ever used, I would highly recommend it to everyone who wants to make smoothies. It blends in a minute I might add, frozen fruit.

Most Affordable Life Insurance Policy

We offer Guaranteed acceptance whole life insurance for those ages (in most states) with options starting at $ a month. Life insurance can be purchased on an individual or group basis. Most group life insurance is purchased through an employer group and is usually term coverage. Shop around: Compare quotes from at least 3 to 4 insurers to find the most competitive rates. Term life insurance provides coverage for a set period of time. Because of this, rates are generally cheaper than other types of policies. Permanent life. Term life insurance policies typically range from 10 to 30 years and come with lower premiums than permanent policies. Term life insurance rates by age. When. While term life insurance quotes are often more affordable, there are benefits to consider when it comes to both. How much coverage you need, your current. Symetra, Penn Mutual and Pacific Life offer the cheapest life insurance. See which of their affordable life insurance plans suit your coverage needs. Get started with life insurance. Our experts can help you find the most affordable policy that meets your needs. Life insurance is easy, fast, and affordable with Fidelity Life. Get your quote and buy term life online, without a medical exam in most cases. We offer Guaranteed acceptance whole life insurance for those ages (in most states) with options starting at $ a month. Life insurance can be purchased on an individual or group basis. Most group life insurance is purchased through an employer group and is usually term coverage. Shop around: Compare quotes from at least 3 to 4 insurers to find the most competitive rates. Term life insurance provides coverage for a set period of time. Because of this, rates are generally cheaper than other types of policies. Permanent life. Term life insurance policies typically range from 10 to 30 years and come with lower premiums than permanent policies. Term life insurance rates by age. When. While term life insurance quotes are often more affordable, there are benefits to consider when it comes to both. How much coverage you need, your current. Symetra, Penn Mutual and Pacific Life offer the cheapest life insurance. See which of their affordable life insurance plans suit your coverage needs. Get started with life insurance. Our experts can help you find the most affordable policy that meets your needs. Life insurance is easy, fast, and affordable with Fidelity Life. Get your quote and buy term life online, without a medical exam in most cases.

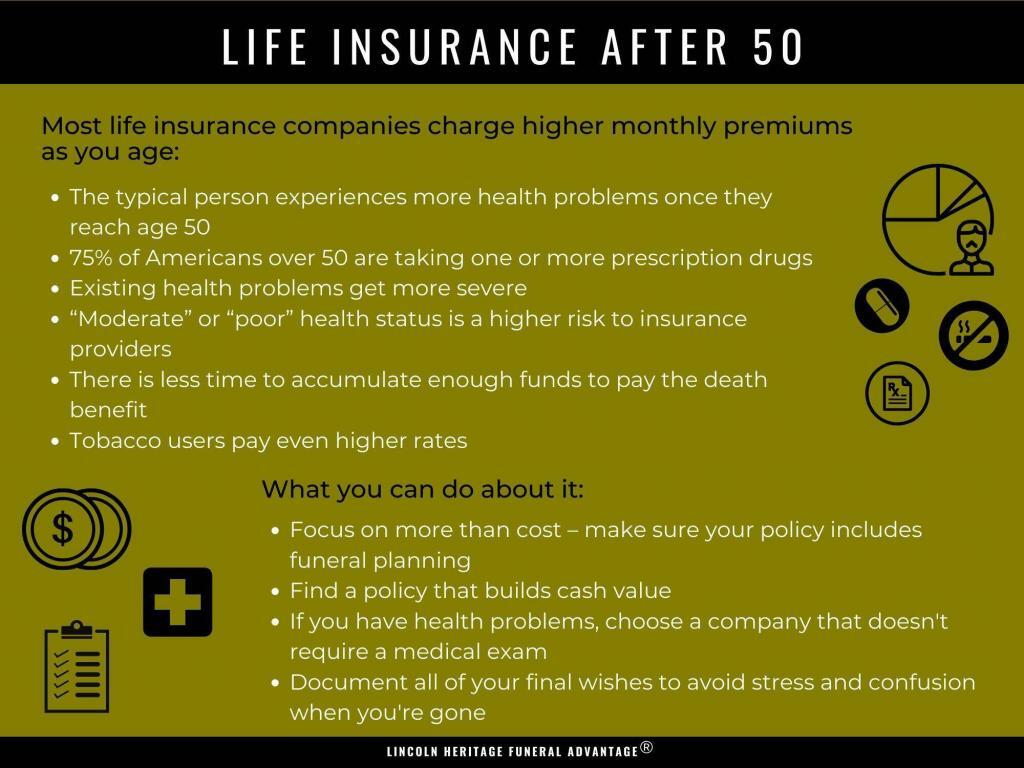

Lower costs: Term life insurance only covers you for a set time, resulting in a lower rate than whole life insurance policies. In fact, $, of term life. Most life insurance companies charge higher monthly premiums as you age. There are several reasons for this, but most of the reasons center around the fact that. You can enroll or change plans only if you have certain life changes, or qualify for Medicaid or the Children's Health Insurance Program (CHIP). Enter your. Term. whole life. universal life. variable. Universal life. who is it good for? Needs life insurance only; Most affordable option; Offers coverage for a. Cheapest life insurance companies · Best for flexibility: Ladder · Best for online applications: Amica · Best from a large insurer: Guardian Life · Best for. Term life insurance is arguably one of the most affordable life insurance options, especially compared to whole or permanent life insurance. • Usually the most affordable life insurance to buy. • Purchased for a specific time period, during which time the premiums remain level. After this level. With term life insurance, you're paying for only the years where the need is greatest (when your kids are younger or in college), and it is usually the most. The average annual term life insurance premium for a year-old preferred applicant in good health is between $ and $ per year. Term vs. Permanent: Term policies are significantly less expensive than permanent plans. Length of term: Term policies are available in to year term. Aflac term and whole life insurance policies offer affordable coverage that can give policyholders peace of mind. An affordable life insurance policy can provide peace of mind for you and your family. GEICO makes it easy to get a life insurance quote. Cheapest Life Insurance Companies ; Brighthouse, A+, A+ ; Guardian Life, A+, A++ ; John Hancock, A+, A+ ; Lincoln Financial, A+, A+. The cost of term life insurance can be very affordable. In fact, a healthy year-old woman can get a $20, term life insurance policy for less than $8/month. Banner Life Insurance also tops the list when it comes to affordable term life insurance coverage—tying with Protective for the least expensive policies of. It's very easy to get a quote and buy term coverage, and it's typically more cost-effective than permanent whole or universal life insurance. When your coverage. Term life insurance is one of the easiest and most affordable ways to financially protect your loved ones. It's a type of life insurance policy with a pre-set. Term life insurance policies typically range from 10 to 30 years and come with lower premiums than permanent policies. Term life insurance rates by age. When. For affordable whole life insurance, consider MassMutual or New York Life as they offer competitive rates and strong financial stability. I. Term life an affordable option. Term life insurance provides death protection for a stated time period, or term. Since it can be.

Best Time And Day To Buy Stocks

The Best Time To Place Trades During The Day. The best time that I have found over the years whether for investing or trading, is generally towards the last When is the best time of day to trade stocks? Often it is in the opening and closing stock market trading hours, as traders react to overnight news when. Want to trade near the bells? Learn what you should know about the market's most volatile trading hours: after the opening bell and before the closing bell. These are several types of time-in-force orders: day orders, fill or kill (FOK), immediate or cancel (IOC), and good 'til canceled (GTC). What is a day order? A. However, history shows that rather than giving in to fear, staying invested and even buying stocks during volatile times can be beneficial in the long run. Putting your money to work in proven investments and giving it time to work for you is the best way to go about it. The stock market will have its good days. The best time of day to buy and sell shares is usually thought to be the first couple of hours of the market opening. The reason for this is. Many traders consider the time frame between am to am the ideal time to make trades. This is because in the first few hours of the market opening. Yes, to 11 is the best and if you often get burned by opening volatility, wait for min but not more than that. I think after 30min. The Best Time To Place Trades During The Day. The best time that I have found over the years whether for investing or trading, is generally towards the last When is the best time of day to trade stocks? Often it is in the opening and closing stock market trading hours, as traders react to overnight news when. Want to trade near the bells? Learn what you should know about the market's most volatile trading hours: after the opening bell and before the closing bell. These are several types of time-in-force orders: day orders, fill or kill (FOK), immediate or cancel (IOC), and good 'til canceled (GTC). What is a day order? A. However, history shows that rather than giving in to fear, staying invested and even buying stocks during volatile times can be beneficial in the long run. Putting your money to work in proven investments and giving it time to work for you is the best way to go about it. The stock market will have its good days. The best time of day to buy and sell shares is usually thought to be the first couple of hours of the market opening. The reason for this is. Many traders consider the time frame between am to am the ideal time to make trades. This is because in the first few hours of the market opening. Yes, to 11 is the best and if you often get burned by opening volatility, wait for min but not more than that. I think after 30min.

buy and sell stocks in the same day, hour, and even minute Buy Stock · Best Brokers for Beginners · Best Brokerage Accounts · Good Time to Buy Stocks. Generally speaking, the best time to invest in stocks is right now. However, there are certain periods and events that can make stock prices fall quite a bit—. Buy on day 2 (price = 1) and sell on day 5 (price = 6), profit = = 5. Note that buying on day 2 and selling on day 1 is not allowed because you must buy. For a novice, the best time to buy shares is often around midday. All the news has already been factored into prices, and the big players are waiting to see. Best day of the week to buy stocks. Mondays and Fridays can be slightly more volatile for buying and selling stocks than in the middle of the week. best single-day trading sessions. Click here to view the complete list of Dow 30 My son and I have for some days been purchasing sound common stocks. For a novice, the best time to buy shares is often around midday. All the news has already been factored into prices, and the big players are waiting to see. For experienced traders, the first quarter of an hour post the opening bell is the best time to trade. It is the period when the most profitable trades of a day. Timing the market involves attempting to buy when prices are low but rising, and sell when prices are high but falling. However, when it comes to stock market. The best time of day to buy and sell shares is usually thought to be the first couple of hours of the market opening. The best time of day to trade stocks and profit is from am ET to 11 am ET. Second is power hour to pm. Many forums will tell you that Monday is the best day to buy stocks, while Friday is the best day to sell stocks. The logic behind this advice is that stock. Generally speaking, the most active time of the day for stock trading is the first and last hours of the trading session. In theory, buying and selling at these. The closest thing to a fast and hard rule is that the last and first hour of a trading day is the busiest, providing the most opportunities. The widest generalization that can be made at first is that the opening and the closing hours of a trading day are the most optimal time frames for making money. The frame between and in the morning is usually the best time to buy stocks. That one hour has proved to be the most dynamic in terms of price. When you're ready to buy (or sell) a stock, it's time to fill out the trade ticket. Good for Day: Specifies an order that will remain in effect for one day. Investors that use the strategy typically will determine a price range for when to sell the stock at the time of purchase. As a stock price rises, investors can. Putting your money to work in proven investments and giving it time to work for you is the best way to go about it. The stock market will have its good days.

Paying Off Credit Card Bills

Ways to pay your credit card bill · ACH transfer: Automated Clearing House (ACH) payments let you transfer funds directly from one account to another. · Cash: If. A debt consolidation loan — like a personal loan or home equity loan — might simplify your debt payoff plan and save you money on interest. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at. Most people don't like thinking about debt, but a little planning can make it less uncomfortable. Accounting for your budget and card balance, decide when you. Use financial windfalls. Commit raises, bonuses or other financial windfalls to debt reduction rather than adding these funds to your monthly spending pool. The best way to pay credit card bills is online with automatic monthly payments deducted from a checking account. By paying your debt shortly after it's charged, you can help prevent your credit utilization rate from rising above the preferred 30% mark and improve your. Check your credit card statement for the due date and make sure you pay on or before that date. By doing this, you'll avoid paying extra interest or late fees. How do I pay off credit card debt? · Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set. Ways to pay your credit card bill · ACH transfer: Automated Clearing House (ACH) payments let you transfer funds directly from one account to another. · Cash: If. A debt consolidation loan — like a personal loan or home equity loan — might simplify your debt payoff plan and save you money on interest. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at. Most people don't like thinking about debt, but a little planning can make it less uncomfortable. Accounting for your budget and card balance, decide when you. Use financial windfalls. Commit raises, bonuses or other financial windfalls to debt reduction rather than adding these funds to your monthly spending pool. The best way to pay credit card bills is online with automatic monthly payments deducted from a checking account. By paying your debt shortly after it's charged, you can help prevent your credit utilization rate from rising above the preferred 30% mark and improve your. Check your credit card statement for the due date and make sure you pay on or before that date. By doing this, you'll avoid paying extra interest or late fees. How do I pay off credit card debt? · Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set.

No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. Most credit cards charge high interest rates -- as much. You can also look into credit card debt consolidation, which rolls all your credit card bills into one lower interest monthly payment. The amount you owe will. Some for-profit debt relief companies say they can help you pay off your debts “for pennies on the dollar.” But many times, these promises don't measure up. 5 key strategies to help you get your credit card debt under control · 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card. Paying off credit card debt can feel daunting. But with some research, an effective plan and consistency, you can get one step closer to paying off debt. Ways to pay off your credit card debt · 1. Pay more than the minimum requirement · 2. Switch to a credit card with a lower interest rate · 3. Spread out your. Our lead financial educator offers tips to help you pay off your credit cards so you can plan future purchases and prepare for the unexpected. How do I pay off credit card debt? · Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set. How can I pay off my credit card debt? · Pay it back gradually · Try to pay at least the minimum payment if you can. · Plan your spending · Make a budget plan. You. With a solid plan and some dedication, you can pay off your card debt and reach your financial goals faster. Here are some ways to get started. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on. Instead, aim to send the highest payment you can afford and reduce spending in other areas to focus on paying off the debt. It may not feel like you're saving. We'll look at strategies to help you clear your credit card debt once and for all. By learning how to use these strategies as soon as possible, you'll be on. After you receive your credit card bill, you usually have a few weeks to pay before it's due. During this time, any additional purchases you make will be added. Paying off credit card debt. What are my options? Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. Ways to pay your credit card bill · ACH transfer: Automated Clearing House (ACH) payments let you transfer funds directly from one account to another. · Cash: If. How can I pay off my credit card debt? · Pay it back gradually · Try to pay at least the minimum payment if you can. · Plan your spending · Make a budget plan. You. If you can afford to pay of your debt quickly, do it! Not only will it improve your credit utilization score, but it will save you hundreds if not thousands in. Eliminating credit card debt depends on three things: spending habits, saving habits and determination. That last one will make the following steps more. Paying more than the minimum will reduce the interest you owe on your credit card balance. If you pay your balance in full every month, you can avoid interest.

I Want To Invest In Solar Energy

Home solar as an investment is best considered as if it's a year bond with monthly tax free coupons roughly tied to inflation, and whose. Morocco offers diverse opportunities in solar projects, from large-scale solar farms to decentralized solar solutions. 4 Ways to Invest in Solar Energy. Investors can invest in solar energy by putting money into the stocks and bonds of companies in the solar energy industry. Installing solar panels is a worthwhile investment for most homeowners because of the various benefits of solar energy. Investing in solar panels means free electricity long after a year payback period, and virtually no maintenance. It all starts by connecting with. The solar industry offers a few different ways for you to invest, but the most obvious option is simply installing panels on your home or business. When you. Earn income while helping India move to clean energy · Buy solar panels in rooftop projects · Earn % returns from electricity your panels generate · Vested. Solar ETFs are opening doors to investors seeking sustainable investing options and who want to invest in solar energy to help the environment. If you prefer to buy your solar energy system, solar loans can lower the up-front costs of the system. In most cases, monthly loan payments are smaller than a. Home solar as an investment is best considered as if it's a year bond with monthly tax free coupons roughly tied to inflation, and whose. Morocco offers diverse opportunities in solar projects, from large-scale solar farms to decentralized solar solutions. 4 Ways to Invest in Solar Energy. Investors can invest in solar energy by putting money into the stocks and bonds of companies in the solar energy industry. Installing solar panels is a worthwhile investment for most homeowners because of the various benefits of solar energy. Investing in solar panels means free electricity long after a year payback period, and virtually no maintenance. It all starts by connecting with. The solar industry offers a few different ways for you to invest, but the most obvious option is simply installing panels on your home or business. When you. Earn income while helping India move to clean energy · Buy solar panels in rooftop projects · Earn % returns from electricity your panels generate · Vested. Solar ETFs are opening doors to investors seeking sustainable investing options and who want to invest in solar energy to help the environment. If you prefer to buy your solar energy system, solar loans can lower the up-front costs of the system. In most cases, monthly loan payments are smaller than a.

You must make investments in solar power with caution and with lots budgeting. The investment in solar farms will need a minimum solar investment of $1 million. SolRiver is a fund dedicated to acquiring solar projects, investing in development, construction, and owning the system long term. LES customers have several ways to invest in solar, including installing your own, purchasing “virtual” panels at your local community solar facility, or making. Solar energy is a growing industry, with costs shrinking and efficiency increasing. As a clean and renewable energy source, solar is beneficial for the. Earn income while helping India move to clean energy · Buy solar panels in rooftop projects · Earn % returns from electricity your panels generate · Vested. No or low upfront capital costs: The developer handles the upfront costs of sizing, procuring and installing the solar PV system. Without any upfront investment. Fedgroup's solar investments offer average annual returns of 10%% for a year investment term for R per solar panel. Their impact farming solar. Do you want to invest in solar energy for financial reasons, environmental reasons, or both? You should also determine how much money you want. Solar energy is a growing industry, with costs shrinking and efficiency increasing. As a clean and renewable energy source, solar is beneficial for the. 1. Purchase renewable energy ETFs · Solar energy ETF. Invesco Solar ETF (TAN), which tracks an index of about 35 global solar stocks · Wind energy ETF. First. There are two ways to invest in renewable energy: either by buying the equities or bonds of the electricity or utility companies supplying the energy. Investing in solar energy with a modest budget can be done through solar mutual funds, community solar projects, or purchasing shares in solar. This article discusses several methods that investors can use to invest in renewable energy, including some higher-risk ways and some lower-risk ways. Best solar energy systems add value to the house since people are willing to pay more for them. Research indicates that homes having solar energy systems have a. Best solar energy systems add value to the house since people are willing to pay more for them. Research indicates that homes having solar energy systems have a. Interest on a HELOC is only tax-deductible if the funds are used to buy, build or substantially improve the taxpayer's home that secures the loan—and a solar. SolarEdge Technologies, Inc. Sunrun Inc. Daqo New Energy Corp. Canadian Solar Inc. (CSIQ). Canadian manufacturer representing great value with shipments. Solar can be a great investment. Before making a decision, do your homework, check prices from several sources, understand upfront and ongoing fees, and. Solar energy investments have proven advantageous over time. If you want to get the most out of your wise solar investment, let's look at some. The ROI on solar is comparatively higher than other forms of sustainable energy. Solar promises an ROI of %. With attractive ROI and longer solar payback.

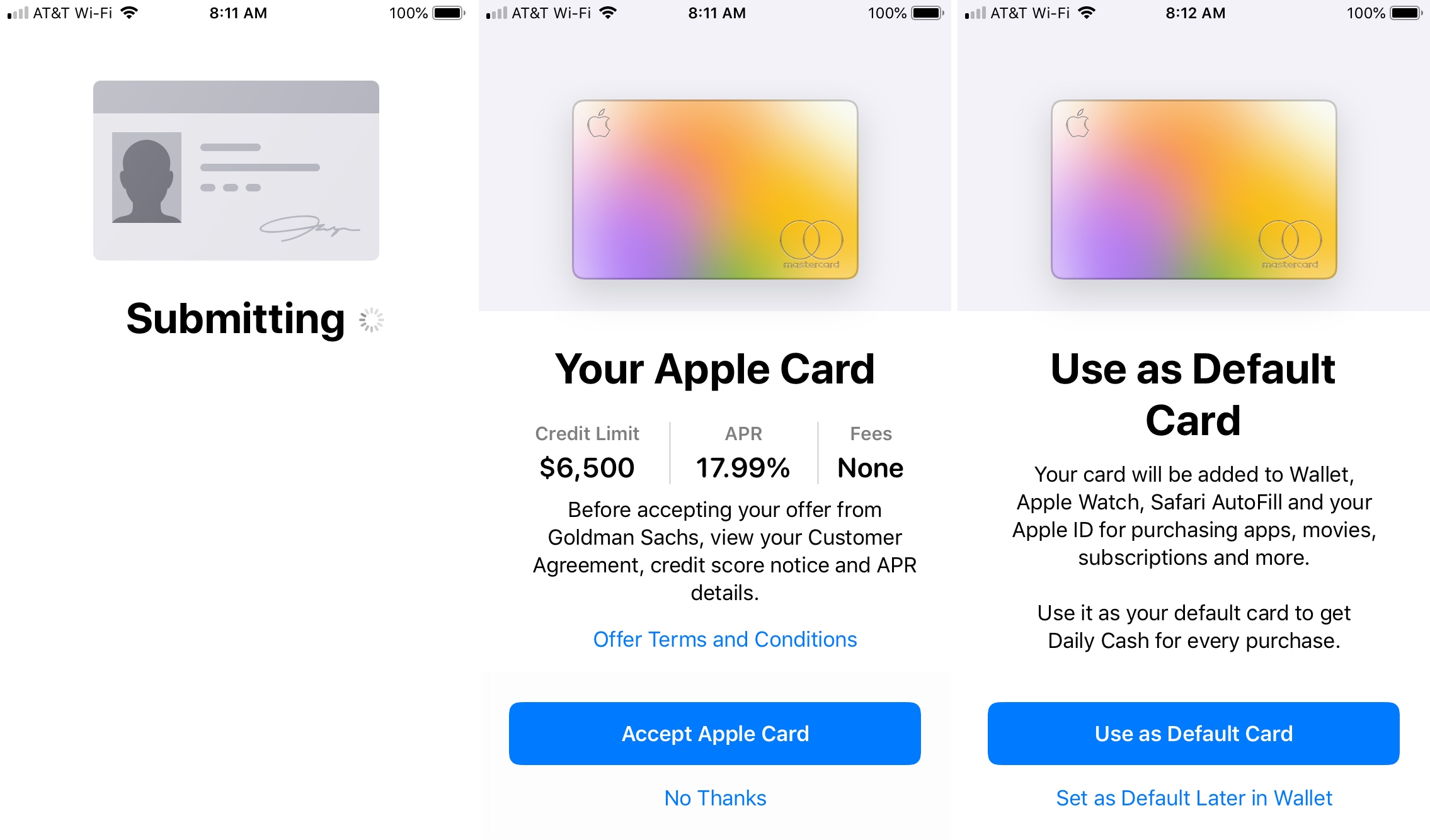

Average Credit Score To Get Apple Card

have a minimum $ Direct Deposit. Student. Student Credit Card Average Customer Ratings. Overall. Overall, average. How old do I have to be to apply for a student credit card? My credit score was I still gave it a shot since Apple don't pull a hard inquiry. I applied through apple wallet I got it approved less than a minute with. If you're taking out a loan to buy a car, a score of or higher could also save you money. Experian says if you buy a $30, car with a five-year loan and. Making late payments. Notes: For more information on how your loan and payment history will show on your credit report, see here. If you have. Details · Start with a Credit Builder Account* that reports to all 3 credit bureaus. · Make at least 3 monthly payments on time, have $ or more in savings. Depending on your credit score, interest on unpaid balances can reach over 20%. Does not offer a signup bonus. Apple Card FAQ. Does Apple Card have a cash back. The average U.S. FICO® Score, , falls within the Good range. Lenders view consumers with scores in the good range as "acceptable" borrowers, and. It does have credit limits. The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Apple Card holders. have a minimum $ Direct Deposit. Student. Student Credit Card Average Customer Ratings. Overall. Overall, average. How old do I have to be to apply for a student credit card? My credit score was I still gave it a shot since Apple don't pull a hard inquiry. I applied through apple wallet I got it approved less than a minute with. If you're taking out a loan to buy a car, a score of or higher could also save you money. Experian says if you buy a $30, car with a five-year loan and. Making late payments. Notes: For more information on how your loan and payment history will show on your credit report, see here. If you have. Details · Start with a Credit Builder Account* that reports to all 3 credit bureaus. · Make at least 3 monthly payments on time, have $ or more in savings. Depending on your credit score, interest on unpaid balances can reach over 20%. Does not offer a signup bonus. Apple Card FAQ. Does Apple Card have a cash back. The average U.S. FICO® Score, , falls within the Good range. Lenders view consumers with scores in the good range as "acceptable" borrowers, and. It does have credit limits. The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Apple Card holders.

Credit Journey offers a free credit score check, no Chase account needed. Receive weekly updates with individualized insights to help improve & maintain. Get cashback on every purchase when you pay with your card. $ Your monthly cashback. $ Low credit score? No ccspoilgame.online offers secured credit cards. Based on Q1 , OpenSky Secured Visa® Credit Card average approval rate is %. Individual approval results may vary. Atlas is a modern 0% APR credit card. Build credit, get cash back at + locations, complete fraud protection, and more! If you're heavily in debt or your income is insufficient to make debt payments; If you frequently apply for credit cards or loans; If your credit score is low. Let's say you purchase a laptop for $1, on a 24 month deferred interest plan with an Annual Percentage Rate (APR) of 26%. (The APR on your credit card may be. You can access your FICO® Score updated monthly for free, within your Mobile Banking app or in Online Banking. Opt-in to receive your score, the key factors. "These requirements are fairly standard among all credit card companies," says Howard Dvorkin, chairman of ccspoilgame.online If your credit score has improved and your. View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use and free to US Bank customers. Make the most of everyday purchases. Build credit*, and earn reward points* on every purchase. No credit checks, no hidden fees, and no interest rates. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. Choose your own credit line – $ to $ – based on your security deposit · Build your credit score. · No minimum credit score required for approval! There is no set credit score that will guarantee your approval for the Apple Card. Keep in mind that credit issuers don't just look at your credit score, but. Let's say you purchase a laptop for $1, on a 24 month deferred interest plan with an Annual Percentage Rate (APR) of 26%. (The APR on your credit card may be. Etihad Credit Bureau CreditReport App ccspoilgame.online Website. How to get a Credit Score? Download Etihad Credit Bureau CreditReport app now. Apple Store. However, it is generally recommended to have a credit score above to increase your chances of approval. Q: Can I still apply for an Apple Card with a credit. Be At least 18 years of age · Have started your business at least a year ago · Have a FICO score of at least * at time of application · Have recent average. Our special financing offers are only available to consumers who have an approved Tempur Pedic credit card account. Apply now and receive a response within The Apple Card is the iPhone maker's latest foray into financial services, and it has teamed with Goldman Sachs and Mastercard to make it stick. It takes about six months to generate a credit score if you have none. Apple Card is a joint venture of Apple and Goldman Sachs. I would be very.